Teaching Kids Smart Money Habits

Lessons in all aspects of your life originate in your childhood, and the biggest teachers are parents. If parents neglect teaching important life lessons, their children will grow up woefully unprepared. Make sure you teach your kids from an early age how to manage money.

Lead by Example

Children learn the most simply by watching the role models in their lives. Without realizing it, everything you do is a lesson. If you show, rather than lecture, the lesson you want to give is more likely to stick. Handle your finances in a way that will have a positive effect upon your children. On US News and World Report’s article Easy Frugal Lessons to Teach Your Kids,1 child psychiatrist Taliba Foster said, “Being frugal is more of a lifestyle, not a lesson. It has to be part of the family lifestyle.” Consistently practice the principles you want to teach in way that easily shows them to your child.

On the flip side, if a parent ignores their duty to teach kids smart habits then the child will likely have no skills when it comes time to manage his or her own finances. Even worse than that is children seeing bad financial principles practiced in their lives. If you constantly use credit cards without checking prices, buy unneeded things, and argue about money problems your child will notice. Instead, try using cash when with children to show that you only buy things you can pay for without going into debt and always compare prices. If you explain your choices when making a purchase, such as why you buy the generic instead of the name brand, your child will learn valuable lessons.

Teach the Value of Savings

Let children be in charge of their own money. Instead of giving them an allowance, Dave Ramsey of Ramsey Solutions suggests giving commissions instead of allowances.2 This creates the ability to show children that money is worked for, and not just given. Award money based on chores done around the house. In addition, instead of an opaque piggy bank, use a clear container for children’s savings so they can see their money grow.

Miranda Marquit of Money Crashers suggests rewarding your children for saving.3 Create goals, and if children reach those goals award them with something that specifically motivates them: extra time with video games, a night at a bowling alley, a new toy—whatever works for your child. Marquit also suggests working with short term and long term goals for savings. College savings, a long term goal, is something that is never too early to start on. An example of a more short term goal is a toy your child wants. If your finances allow it, Marquit even suggests going as far as to match your child’s contribution to savings. This creates an extra motivation for kids to save.

Use Age-Appropriate Lessons

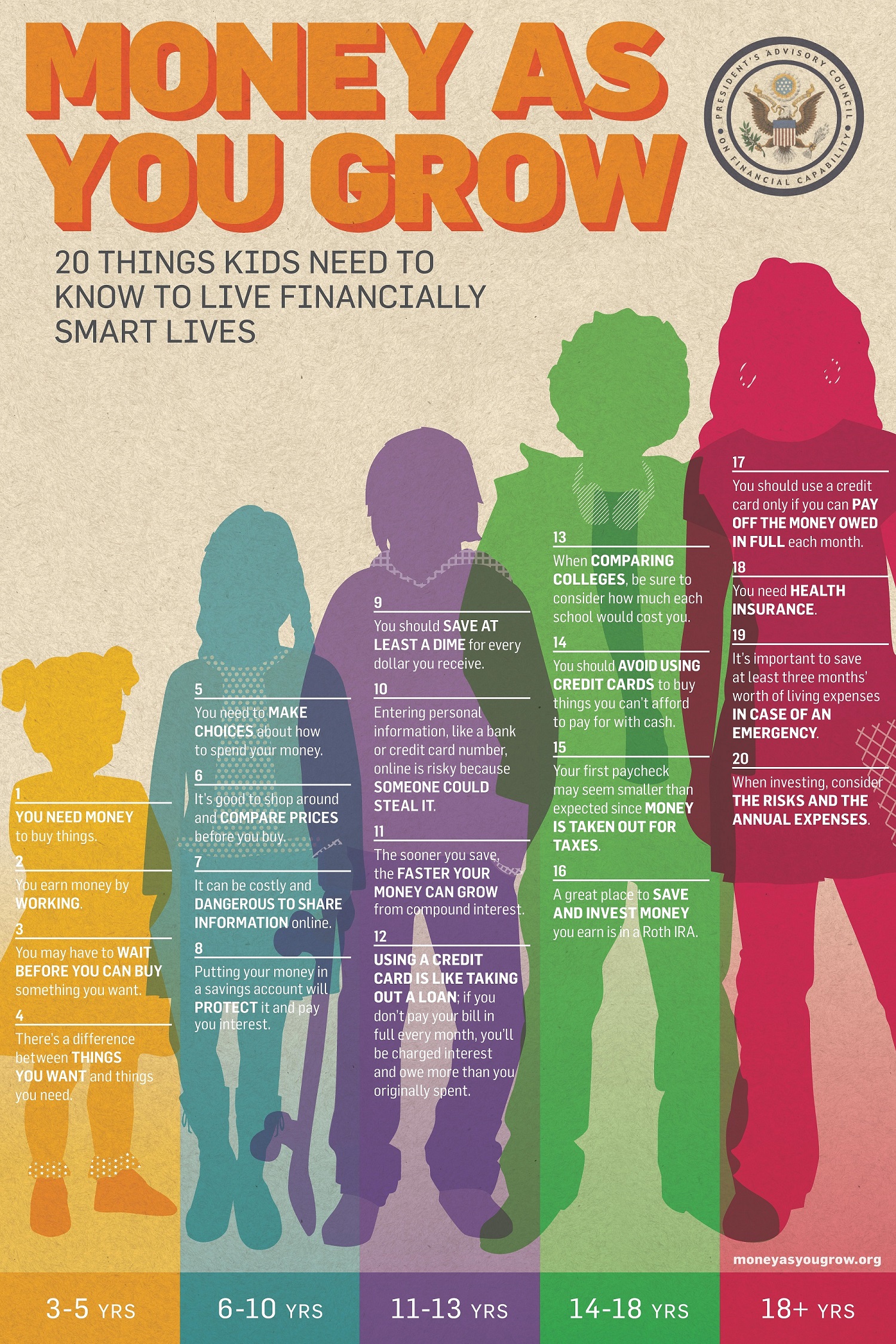

Different stages and maturity levels require different lessons and complexity. The infographic shown above from Money as You Grow is a handy, simplified guide of what should be taught at what age. This infographic is available to download and print for free from moneyasyougrow.org if you would like to use it as a learning tool.

The basics are as follows: At 3-5 years old you should teach children about money, differences between wants and needs, and delayed gratification. From 6-10 years old you teach about price comparisons and savings. At 11-13 years old explain compound interest, online shopping, and credit card basics. Once the child reaches 14-18 you explain how taxes work and about the cost of college. This is also a good time to encourage children to get a job. Once the child reaches 18 you make sure they understand credit cards should always be paid in full, the value of an emergency fund, and investment risks.

Ultimately, teaching children comes down to practicing good financial principles in the home and explaining yourself. Don’t get sloppy when it comes to your finances because then your children may be sloppy with theirs. Remember, all the lectures in the world will mean nothing if your child doesn’t see you implementing the same principles you teach.

The views expressed by the articles and sites linked in this post do not necessarily reflect the opinions and policies of Cash Central or Community Choice Financial®.

Source:

1Crowe, Aaron. (2014, Jan 31). Retrieved from: https://money.usnews.com/money/personal-finance/articles/2014/01/31/10-easy-frugal-lessons-to-teach-your-kids

2Ramsey Solutions. (2022, Nov 28). Retrieved from: https://www.ramseysolutions.com/relationships/how-to-teach-kids-about-money

3Martucci, Brian. (2021, Aug 19). Retrieved from: https://www.moneycrashers.com/teaching-kids-save-money/

You must have JavaScript enabled to use this site.

You must have JavaScript enabled to use this site.

For a better user experience consider upgrading your browser.

For a better user experience consider upgrading your browser.